Not since the days of inflation and high interest rates have Certificates of Deposits (CDs) been perceived as a viable source of income for retirees and conservative savings for working individuals.

For years, banks used CDs as primary marketing products to attract new customers and help build deposit bases. As rates fell substantially, CDs became less attractive, incentivizing banks to find other products to sell. The historically low rates of today have created CD yield wars with rates from .25% to 1.00%, rates not seen since 2002.

The primary drawback of using CDs as an investment is that a fixed rate over a short period of time doesn’t produce the growth that stocks may produce over a long period of time.

Contrary to what most people think, a CD isn’t as liquid as many believe. Banks restrict access to the funds until the maturity date of the investment and impose penalties for early withdrawals.

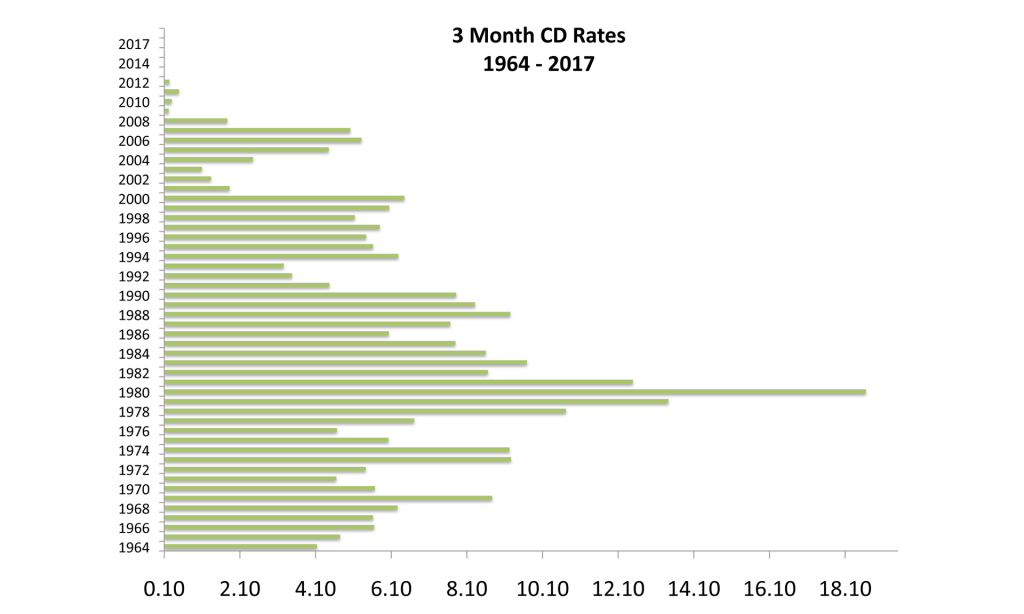

Data compiled by both the FDIC and the Federal Reserve over the decades has carefully tracked CD rates offered by banks nationwide. The average 3-month CD as of this past month has a rate of 0.91%, roughly 1/10th of a comparable 3-month CD in 1983.

So when a 3-month CD paid 13.78% in 1979, the inflation of 13.3% that same year translated into earning a meager half percentage difference in real terms net of inflation. The challenge today, even with low inflation of below 2%, is that the average 3, 6, and 12-month CD rate is still below the current rate of inflation.