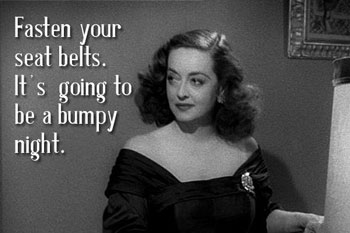

Food For Thought? The quote for this month’s irrational behavior by naïve amateur traders trying to “Stick it to the Big Boys:”

Even more than a bumpy night, for many of the inexperienced newbies it is going to be a very expensive learning experience. Shorting stocks is not new, just a recent media discovery (“Look what I found, the little guys getting even with the Wall Street Masters of the Universe!) in a time of limited headline events.

Shorting stocks is simply a technique used, normally by knowledgeable investors or traders/hedge funds, in which there is a strong conviction that a company is selling at a price well in excess of its intrinsic value. The current case of GameStop is a good example: it is a brick-and-mortar company in the business of selling boxed versions of electronic games and is rapidly losing market share to electronic streaming of games. Other factors add to their problems including lower, even negative, earnings: declining mall traffic, Covid-19, and inventory cost.

Those who believe the company’s stock is overpriced and is likely to decline in price see it as an opportunity to profit in what one might call ‘negative investing.’ In hopes of profiting, they decide to sell it, but they don’t own it and therefore must borrow stock from another investor to have the issue to sell, thus, they are selling something they don’t own, i.e., selling short. If the stock does go down in price, they can buy it (cover the short) and return it to the source from which it was borrowed. The difference in price between what it was sold for and what it was bought for becomes profit.

But what if it doesn’t go down in price? What if it begins climbing in value? Ah, there’s the rub. When a shorted stock goes down in price the most one can make is the difference between what it was sold for and zero. But—and this is a big ‘but’—if the stock goes up, the risk can be infinite: suppose it was sold at $20 and it has appreciated to $30. The trader decides to get out of the trade (cover the short) from concern that it might go higher, so he buys, paying thirty dollars for a stock he sold at twenty. Whoops, now the difference is a loss of $10—50%! And if he should choose to not buy it, he could watch his losses mount as the issue climbs higher. How high could it go? There is no limit.

But what if it doesn’t go down in price? What if it begins climbing in value? Ah, there’s the rub.

When a shorted stock goes down in price the most one can make is the difference between what it was sold for and zero.

With GameStop there was a substantial amount of the stock, over 88%, that had been sold short. A large group of mostly relatively inexperienced traders and millennials who participated in a ‘chat room’ in which gossip, rumors, and rank speculation fueled short-term buying and selling. Much of that activity occurred on commission-free sites such as Robin Hood, with the novice traders’ collaboration focused on buying GameStop. That began pushing the stock higher, which meant that if the hedge funds who were the source of shorting most of the stock wanted to buy stock to cover their short positions, they would add to the buying pressure, pushing the stock even higher.

The media have kept us blaringly informed of the billions lost on the trades as those with short positions scrambled, at ever increasing prices, to cover their short positions. In the parlance of Wall Street, that is called, “Squeezing the shorts.” (Hey, I don’t make these up, I just pass ‘em on.)

But what about the ’little guy’ who was part of the amateur cabal that began buying the stock to force it higher and ‘Stick it to the Big Boys?’ The range of prices at which GameStop traded during this “Tulip Mania’ like frenzy was $2.87 to $483.00!!! I expect that little will be reported by the media about those who have learned a bitter lesson about getting caught buying vindictively and then watching the fall of the price. Each generation has lessons to be learned, not just investing lessons, but life lessons. As my Dad liked to say, “You learn from your mistakes: they build character.” (Hmmm, I must have built a lot of character during my lifetime.)

Let’s wrap this up with a pithy (I have always liked that word) investing aphorism that, “He who sells what isn’t his’n, buys it back or goes to prison.”

Stay safe.