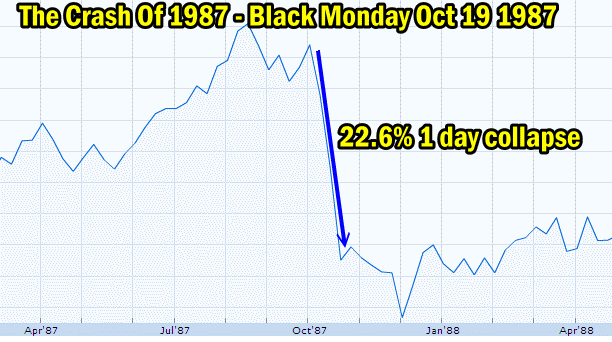

Black Monday—1987! Over a 22% decline in one day!

We didn’t have the computer systems then that we have today, so I was up until around 2-3:00 a.m.with a yellow legal pad, a couple of pencils, and a hand-held calculator. The bargains were every where. They had happened so incredibly quickly that even if one had a normally steely discipline, the level of, “Oh my god, we’re collapsing,” was so great, so pervasive, that many traders and investors sold or became frozen with the stronger of the two investing emotions—fear.

For we who were then (as now) serious, value-oriented investors who emphasize dividend growth and appreciation potential, it was, to coin a phrase, ‘like shooting fish in a barrel.’ We didn’t call the bottom of the market (1738) that day, but that’s not what we do. Instead we bought undervalued companies with strong balance sheets and a long history of dividend increases. Yes, several issues declined a bit further before beginning upward moves; however, over the following months and years they provided the income and growth we projected, as clients who were with us during that period can attest.

Which brings us to today’s investment environment. Interest rates are at an all-time low, with mortgages under 3%, the 30 year treasury under 1% (unbelievable!), and savings rates smaller than a fly speck, the dividend yields for companies on our Great American Companies acquisition list are as high as 4 to7 times those rates. (Great sources of income for investors wanting more income than deposits and savings provide.)

To coin another phrase: “We are champing at the bit,” at opportunities the fears created by the coronavirus hysteria are developing. We are neither criminologists nor epidemiologists, but would wager that in Saint Louis more individuals will die this month from gunshots than the virus.

Daffodils are peeking out and popping up. Think Spring!