“Damn, have you seen the price of lumber?” Our friend Dan asked over a beer after work last week. He went on to tell me how much it cost him to replace the deck on his house, which in turn led to more examples of inflation and another beer. We even covered what causes inflation, which in short form is very basic, so here’s a go at it:

There are basically two types of inflation, cost push and demand pull. If the cost of raw materials and/or labor in the production of goods and services increases, to maintain profitability and the existence of the business, prices for finished goods must increase. That is cost-push.

When consumption exceeds production, regardless of the cause, (think pent-up demand such as we have experienced during the Pandemic finally being fulfilled) prices increase. Two current examples are the demand for homes and automobiles, new or pre-owned. (Several clients have sold their homes for more than their listed prices!)

Exacerbating the current demand-pull inflation is the profligate Government flooding of the economy with money. Stimulus money, infrastructure dollars (there are some weird items considered infrastructure), and the fear among many investors that the increase in the money supply, creating more dollars to fuel spending, will outpace production, generating inflation for a prolonged period at a rate growing above the Fed’s targeted 2%.

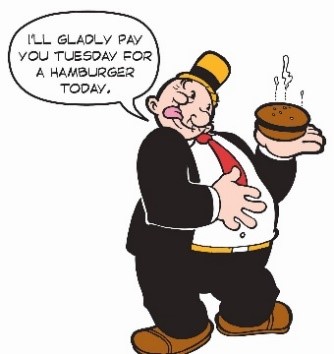

And then there’s the long -term outlook for the economy and politics. We do not have a crystal ball, nor can we read tea leaves, but we do know this: at some point the Piper must be paid. The growing U.S. debt is alarming and there is no evidence at this time of it shrinking—of any reduction even being remotely considered by either party, only the intent to garner votes by spreading the give-away programs, that will hang over our kids and grandkids—and beyond. (We wrote about one such program last month—being paid more to stay home than to work.) That reminded us of the memorable Popeye cartoon character J. Wellington Wimpy, affectionately known as ‘Wimpy.’

We can’t predict when the Government’s Tuesday will come, but we will continue monitoring the situation, with an eye to protecting your annually increasing dividend stream and principal.